What would you do if you had to choose between paying your light bill, buying groceries or purchasing medication? Virgin Islands retirees may have to make those tough choices in the coming year.

The V.I. Government Employees’ Retirement System board is seeking to have the V.I. Legislature approve further cuts to retirement annuities.

According to the Revised Organic Act of 1954, the GERS board does not have the statutory authority to adjust members’ benefits; only the Legislature can do that.

The GERS Collapse, Part 1 –

How Bad Is it and How Did We Get Here?

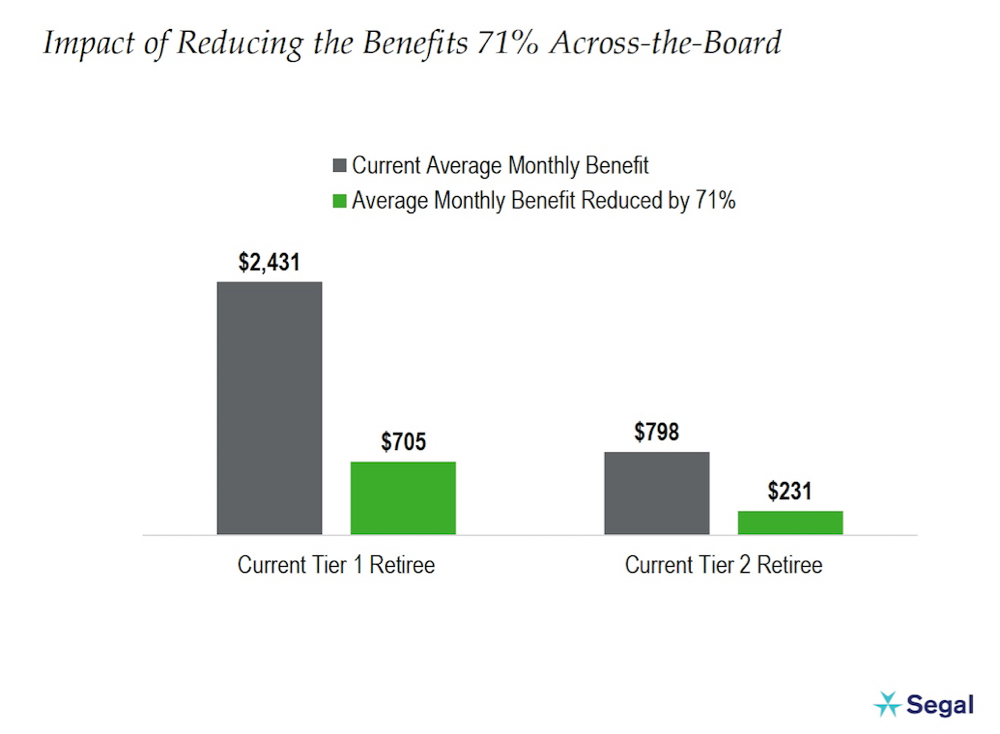

GERS’ financial advisor, Segal Consulting, estimates the reduction in payouts to older, better-compensated retirees will shore up GERS’ finances enough to prevent even larger, across the board cuts affecting all retirees when the trust fund bottoms out in a couple of years. Right now, a Tier I retiree averages $2,431 per month and a Tier II retiree averages $798 per month in pension payments. The proposed 42 percent cut would bring Tier I down to $1,410 and leave Tier II alone. The worst-case scenario of a 71 percent across the board cut would leave Tier II retirees with only $231 per month.

Without a viable solution, the clock is winding down on the number of days left before GERS will no longer be able to disburse retiree pensions due to a financial shortfall totaling more than $4.2 billion. Testifying before the V.I. Legislature in August, GERS Administrator Austin Nibbs said 8,699 retirees rely on payouts twice per month as a primary source of income. Conversely, the government only employs 6,148 people and receives contributions from 2,733 semi-autonomous workers. Under this scenario, the contributions from active employees are not sufficient to support the number of beneficiaries. This is at the heart of the matter.

It is compounded by years of amendments to the V.I. Code that provide early retirement to certain classes of government workers without sustainable funding sources. Lawmakers, who have authorized cuts to annuities in previous years, are now faced with the task of identifying alternate sources of revenue for the overburdened retirement system without sacrificing the incomes of this vulnerable demographic.

Based on Nibbs’ August testimony, the average pension of a retired government worker is $29,328 per year. Given the increased cost of living in the territory, daily living will be a challenge for many.

Virgin Islands retirees, who make up almost 10 percent of the population, shared their views on what this cost-cutting measure would mean for their futures and that of the local economy.

Many are anxious about how to make ends meet, but there is a greater degree of concern for those who retired earning less than $20,000 per year.

Quality of Life

Willard John, an entertainment consultant, the territory’s preeminent moko jumbie and retired educator, retired in 2015 from the Virgin Islands Department of Education after 38 years of service.

“It would be devastating and would change my whole life,” said John. “I arranged my whole life and my future based on what was promised [at retirement]. It would probably mean that I would have to obtain a part-time job at my age to maintain my lifestyle,” he said.

Donald Charles Sr., who retired in 2008 as assistant director of the Virgin Islands Fire Service, also wonders about the future. Charles, who runs a local business with his wife, benefitted from the early retirement option for hazardous duty personnel after 20 years of service to the Virgin Islands government. He expressed concern about how he would maintain his off-island medical care and the costs associated with travel. “A 42 percent cut to my retirement pension would mean that I have to replan my post-retirement life. It would restrict me from 42 percent of the things I planned to do at this time in my life,” Charles said. “My grandkids live away. I travel quite frequently to see them and would have to cut back on that.”

One senior, who retired from the Department of Health almost three decades ago is now in her 90s. She says she is “concerned” about the cuts but is not worrying. She did, however, have some strong opinions about the elected officials who accepted and sanctioned pay raises rather than address the financial deficit facing GERS.

“When I came to St. Thomas from Antigua in 1963, they were projecting this [shortfall]. Every governor swept it under the rug and now this governor has to deal with it. It’s not fair to take from people who already retired,” she said.

The impact of the shortage extends beyond the local community to retirees who have relocated to the U.S. mainland. It also affects current government workers who have contributed to the system and may not benefit when they are eligible to retire.

A retiree who relocated to Florida after 30 years at Charles Harwood Hospital on St. Croix, laughed nervously when asked what the proposed cuts meant for him.

“It’s going to hit me hard because that’s what I live off of. They don’t seem to understand what it’s going to do to people. Living away comes with other expenses. This is what I pay my everyday bills with,” he said.

A current employee with 24 years of service also shared thoughts on what the proposed changes would mean.

“I am not like the younger persons who can opt-out after eight or nine years and get their money. If they are cutting now and I want to retire in six years, I will literally have to get another job in order for me to live because I am not even 60 yet,” the employee said. “How am I going to be able to live without a second job on the little pittance that I will be receiving after 30 years in the government? Because of this, I will be forced to remain in the system until I’m 62,” she said.

Beatrice Benjamin-Gumbs, who retired from the Department of Human Services in 2012 at the age of 51, echoes that sentiment.

“Basically, it would put me in a financial predicament because I’m still young. We are still paying off debt and my choice to retire as young as I did was because my parents were getting down and we needed to provide care for them,” Gumbs said. “I had worked out my budget and what I can survive on. If they cut my annuity it would really put a stranglehold on my budget right now. I am too young to get Social Security for another four or five years, so without that additional income to help me, I would have to consider going back to work. But I can’t because I am a full-time caregiver for my 96-year-old aunt,” she said.

Impact on the Community

For many of the retirees, the impact on travel for personal and medical reasons topped the list of issues they are facing. However, they also had in common a sense of trepidation about the economic tsunami that could result from the cuts. Whether supporting local restaurants or beauticians, residents with disposable income help keep the economy running. The impact of almost 10 percent of the USVI population losing almost half of its annual income in the midst of a global pandemic presents repercussions that are not yet known. The residual effects of this deficit will certainly have a negative impact on small and large businesses over time.

Another consequence is the inevitable strain on human services and other government supports. There is an overwhelming unease about what will happen to retirees whose salaries are at the lower end of the scale.

One St. Thomas retiree, who left the government after 39 years as an educator and administrator said, “A lot of retirees aren’t in the position to take that cut. It’s not even 5, 10 or 15 percent. When you’re on a fixed income with a mortgage to pay, it’s a huge loss that will impact the economy. The leaders don’t realize what they’re doing. I know they’re trying to find ways and means but it’s always on the backs of the people of the V.I. How are retirees who pay rent going to survive? Did [leaders] seriously think about this?” she said.

Another retiree on St. Croix worries about those in the community with already low incomes as well. She also questions whether there has been enough discussion about finding a more suitable resolution.

“No one has said what categories they will use and which salaries they will cut. We can’t go elsewhere to work. What’s going to happen to those with families who are already pinching pennies when they go to the store?” she said.

John agrees.

“It would deal our community quite a blow with lots of aftereffects because there would be less money to circulate in the economy. Obviously, they’re going to have to restructure the whole structure – but not at the expense of the people already retired,” he said. Another retiree, living in Texas, also expressed frustration.

“The senators made themselves a fat retirement salary. They aren’t thinking of the little man, they are thinking of themselves,” he said.

Financial Outlook

Some retirees have begun to adjust their finances in anticipation of the reduction to annuities, but not everyone has that luxury. Charles considers his family business and rental income to be his “plan B.” Others who may have savings or other supplemental income still worry that the economic damage done by the coronavirus pandemic will only worsen their ability to pass along generational wealth or plan for contingencies. They also are not prepared to reenter the workforce in their 70s or 80s.

“My next step is for my husband and I to consolidate and streamline certain things and cut back on unnecessary spending. Staycations will be part of the norm for a while,” Benjamin-Gumbs said.

Another retiree is thankful for the income her rentals provide but acknowledges that the higher cost of living on St. John doesn’t provide much wiggle room for such a reduction income. She is especially concerned about how her counterparts without other income streams will fare on the sister island.

“I don’t think this will impact my ability to pass along something to my family, but what about those who don’t have anything?” she said.

For one government worker, hindsight is 20/20.

“I do have savings; however, knowing now what’s ahead, I could have made moves and left the government or invested into my own 401k retirement plan and I would have been okay,” she said.

Barbara Isaac, a retired educator with 32 years in the school system, is the treasurer of Government Retirees United for Fairness, Inc. (GRUFF) and a vocal advocate against the annuity cuts. She is dissatisfied with the silence of government and business leaders on the issue and questions why innovative solutions aren’t being brought forth. “If you cut my pension by 30 percent or more and I go to do my hair or nails or buy dinner, the luxuries that I don’t need, I can’t do that anymore. Whatever is left has to provide for myself, rent or mortgage, car loans and deductible on medicines. Therefore, what businesses haven’t closed because of the pandemic will close down because of the retirees. The Virgin Islands economy would tank, and we will suffer immensely. We have 92-year-old retirees who earn approximately $400-$500 per month after insurance deductions. The savings under this measure are not significant enough to justify moving forward. You have to prove me wrong,” she said.

What’s Next?

Despite the reality that the GERS crisis has been decades in the making, it is a consensus among retirees that cutting their annuities should not be the only option on the table. Some retired people offered suggestions on how to help the system moving forward, although none of the suggestions would preserve the pension plan in its current form or prevent sharp cuts.

One idea was a lump-sum payout that could be reinvested in a retirement plan they could manage independently. Another recommendation was to redirect the gasoline excise tax that currently funds WAPA into GERS.

“This is not rocket science. WAPA is getting close to a billion dollars from the federal government to upgrade its systems so let’s pull that 14 cents into GERS. We have 15 senators. If each of them came up with something that would generate five million a year that’s $75 million. That makes a difference,” a retiree suggested. The fuel tax, currently securing leases on generators for WAPA, generates about $4 million per year, or roughly 3 percent of the GERS loss.

Yet another thought was to tap into the revenues from the gaming community, given the popularity of video lottery terminals in the territory. One St. Thomas-based retiree who ended his 32-year tenure in 2004 said, “Casinos are a popular source of entertainment for seniors. Since the marijuana industry is not yet active to support the governor’s plan and retirees are spending their money in the casinos, why not collect some of the money from Southland Gaming? I’m not sure what their revenues are, but they are making a killing,” he said.

Southland Gaming’s video lottery slot machine revenues are divided according to a signed contract, so the government cannot take more of the money unless Southland agrees. Out of gross revenues of around $28 million per year, about $10 million goes into government coffers from both gross receipts taxes and contracted gambling taxes; businesses with video lottery slot machines get about $6 million for hosting the machines and the company gets something in the ballpark of $13 million for providing and maintaining the slot machines.

GRUFF representatives hope that more residents will play an active role in what happens next with GERS, given the impact on the entire territory.

“This is not just a retiree issue. If people [including union leaders] put pressure on the elected officials, I feel something could be done. The young people may not be thinking that long term for now because retirement seems far away, but this situation affects them too. Even businesspeople need to get involved. They’re not saying anything but it’s their businesses that are going to suffer. This is not just a retiree issue, we need local business, current employees, Virgin Islanders living away, everyone to put pressure on the Legislature to come up with a solution because it will affect all of us,” Isaac said.