The Legislature approved a “historic” bill during Monday’s legislative session that provides a financial plan that could liberate the Government Employees’ Retirement System from its anticipated insolvency projected for October 2024.

Senate President Donna Frett-Gregory said the approval of the bill by the Legislature was “Awesome. A historic moment that we actually came together and did the right thing. We are good people, and we did the right thing.”

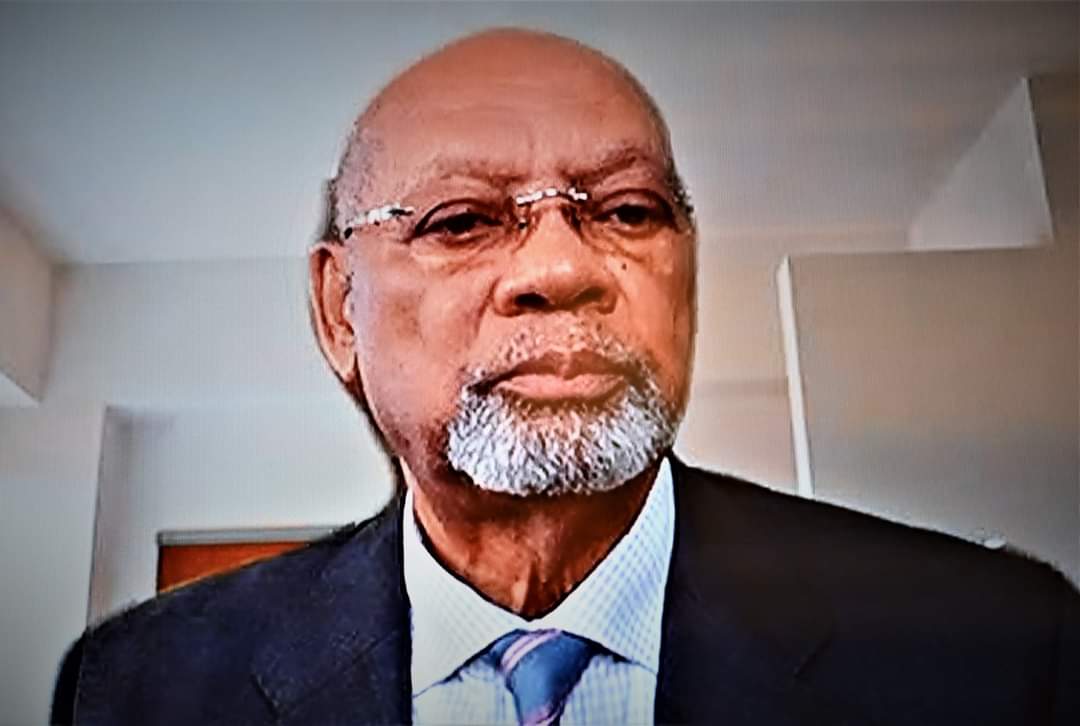

Already on its fourth revision, the bill’s financial plan includes creating a special purpose financing vehicle (an entity created to fulfill a specific task) that will be called the Matching Fund Special Purpose Securitization Corporation. GERS Board of Trustees Chairman Nellon Bowry said the government will then surrender its rights to all interest on “future rum cover over receipts” to this newly formed corporation. In doing so, it will allow the issuance of “refunding bonds” that refund $658 million of remaining PFA Matching Fund Bonds.

Any Matching Fund (annual rum cover over) receipts remaining after paying the debt service on the Refunding Bonds and contractual obligations will be used to make an annual contribution to GERS, added Bowry.

The bill “enables a plan that will provide significant annual contributions to the GERS – in addition to existing payroll-based employee and employer contributions – enough to fund the currently defined benefits promised to the members of the GERS, for the foreseeable future,” Bowry said. “It averts the predicted insolvency and, with it, the dreaded and scary retiree benefit reduction for the next 30 years.”

Gov. Albert Bryan Jr. issued a statement on Monday thanking the 34th Legislature for passing the bill

Bryan first proposed his plan in December 2019 to refinance the GVI debt at a lower interest rate and use the resulting savings from that transaction to provide a revenue stream for GERS over 30 years, his statement noted. That legislation and two more amended versions of the measure failed to pass the Senate until Monday’s historic bill, which removes the impending threat of the retirement system becoming insolvent.

“The fourth time is a charm. Today we took a historic step for the people of the Virgin Islands,” Bryan said in his statement. “At the end of the day, I am determined to get things done for the people of the Virgin Islands no matter what it takes. I thank Senate President Donna Frett-Gregory and the entire body of lawmakers for their work on this. Together, we will always make it happen.”

The governor also thanked his executive team, the attorneys, bond counsels and underwriters for their perseverance in working to come up with a solution to stabilize GERS. He said that the Senate’s approval of the bill now allows the GVI to begin the work of securing the bonds from the rum cover-over funds.

“We have worked long and hard to get this legislation to this point. We have more work to do to bring this across the finish line, but we have to celebrate this amazing achievement,” Bryan said.

V.I. Public Finance Authority Director of Finance and Administration Nathan Simmonds said without the legislation, GERS would become insolvent, and retiree obligations would become the burden of the government’s General Fund, “requiring estimated supplemental funding of $150-160 million annually above current statutorily required contributions.”

Absent any funding, Simmonds added it was likely the system would have had to reduce benefits by 50 to 55 percent.

Though legislators endorsed the bill, Sen. Kenneth Gittens advised adding amendments later to improve accountability during the contract procurement process. “With the new SPV (corporation) in place, what assurances do we have there will be proper procurement policies and procedures in place regarding all contracts?” he asked.

Simmonds said the corporation would have managing agreements with the Public Finance Authority, “so all procurement and anything we do would be under the established PFA procedures.”

Sen. Samuel Carrion said perhaps amendments could be included later, and there is no perfect piece of legislation, but “this is way better than we had.”

Like the other 12 senators who signed on to the “complex” legislation as sponsors, Sen. Kurt Vialet said, “We believe it will change the path moving forward for the Government Employees’ Retirement System.”

Sens. Frett-Gregory, Carrion, Vialet, Gittens, Novelle Francis Jr., Javan James Sr., Steven Payne Sr., Franklin Johnson, Marvin Blyden, Janelle Sarauw, Genevieve Whitaker, Alma Francis Heyliger, Carla Joseph, Dwayne DeGraff, and Milton Potter were present for the hearing.